The Evolution of Bitcoin Cash: From Genesis to Cutting-Edge Functionality

Welcome to this first edition of the Ihler.Tech Newsletter! Today, we're diving into the journey of Bitcoin Cash (BCH), a cryptocurrency designed to fulfill Bitcoin's original vision as peer-to-peer electronic cash. Since its genesis block in 2017, BCH has evolved through a series of targeted upgrades, emphasizing scalability, low fees, and practical global usability. I'll trace its key changes over the years and compare its functionality to Bitcoin (BTC), highlighting how BCH prioritizes on-chain efficiency for everyday transactions as described in the original Bitcoin Whitepaper.

Origins and the Spark of Change

Bitcoin Cash emerged on August 1, 2017, at block 478,558, as a hard fork from Bitcoin. This split was driven by the "block wars"—intense community debates over how to scale the network amid growing transaction demands. Proponents of the Bitcoin Whitepaper believed in on-chain solutions to keep fees low and speeds high, leading to BCH's creation. From day one, BCH increased the block size limit from BTCs destructive 1 MB to 8 MB, added replay protection, implemented an Emergency Difficulty Adjustment (EDA) for stable mining, and rejected SegWit to maintain a straightforward and lightweight protocol.

This foundation set BCH apart, focusing on usability rather than just supposed value storage. Let's explore the major upgrades that followed.

Key Protocol Upgrades: A Timeline of Innovation

BCH has followed a regular upgrade schedule—initially every six months, shifting to yearly after 2023—to introduce features that enhance performance, security, and versatility. Here's a breakdown of the most significant changes:

- November 2017 (Block 504,031): Upgraded the Difficulty Adjustment Algorithm (DAA) to adjust mining difficulty every block based on the previous 144 blocks, ensuring consistent 10-minute block times and smoother network operation.

- May 2018 (Block 530,000): Block size expanded to 32 MB for higher throughput. Reenabled opcodes like OP_CAT and OP_SPLIT for advanced scripting, and increased OP_RETURN data limits to 223 bytes, laying groundwork for metadata and early tokenization.

- November 2018 (Block 556,766): Introduced OP_CHECKDATASIG for verifying signatures with external data, enabling oracle-like functionalities. Added Canonical Transaction Ordering (CTOR) for efficient block propagation and a 100-byte minimum transaction size to curb spam. This upgrade caused a contentious split, resulting in Bitcoin SV (BSV) forking off - led by Craig Wright, an Australian computer scientist who has claimed since 2016 to be Satoshi Nakamoto. Wright pursued aggressive lawsuits against developers and critics to silence opposition, only to suffer humiliating defeats in court, including a 2024 UK ruling that comprehensively debunked his identity claims and exposed fabricated evidence leading to him earning the nickname Faketoshi. (I will dive into these chain of events in a later newsletter.)

- May 2019 (Block 582,680): Implemented Schnorr Signatures for aggregated, space-efficient signatures, boosting privacy and reducing transaction sizes.

- November 2019 (Block 609,135): Enforced stricter Minimal Data Rules for transaction validity and added SegWit Recovery to reclaim funds sent to incorrect addresses.

- May 2020 (Block 635,258): Replaced legacy SigOps with SigChecks to prevent denial-of-service attacks and improve scalability. Added OP_REVERSEBYTES for more flexible scripting.

- November 2020 (Block 661,648): Adopted the ASERT Difficulty Adjustment Algorithm, using an exponential moving average for even more precise block timing.

- May 2021 (Block 687,456): Introduced Double Spend Proofs for real-time detection of double-spend attempts, allowed multiple OP_RETURN outputs, and removed limits on unconfirmed transaction chains for seamless large-volume transfers.

- May 2022 (Block 733,000): Expanded script integer sizes for complex calculations and added Native Introspection Opcodes, allowing scripts to access transaction details directly—paving the way for sophisticated smart contracts.

- May 2023 (Block 792,000): Launched CashTokens, supporting fungible tokens and NFTs on-chain. Enhanced covenants for features like time-locked vaults and recurring payments, plus opcode improvements for DeFi and decentralized apps (DApps).

- May 2024 (Block 850,000): Implemented the Adaptive Blocksize Limit Algorithm, which dynamically adjusts block sizes based on network demand to optimize scalability without fixed caps.

- May 2025 (Latest Upgrade): Activated Targeted Virtual Machine (VM) Limits for efficient resource management in scripts and BigInt for high-precision arithmetic. These changes supercharge smart contract capabilities, making BCH more developer-friendly for building advanced applications while maintaining low costs. This upgrade solidifies BCH's focus on scalability and utility, with proposals like faster 2-minute blocks under discussion for future enhancements.

These upgrades have transformed BCH from a simple fork into a robust platform, handling up to millions of transactions per day with minimal fees.

Functionality Showdown: Bitcoin Cash vs. BTC

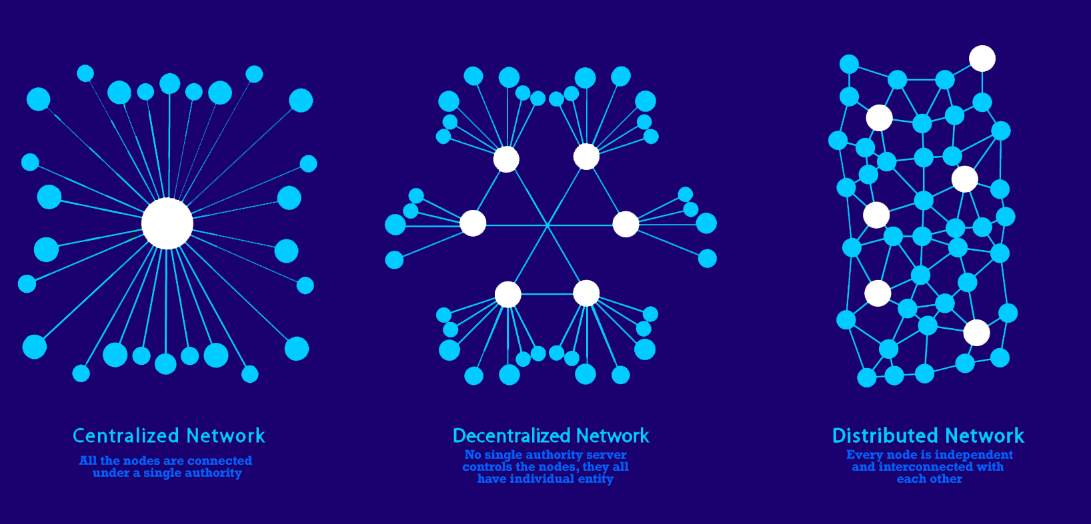

While both BCH and BTC share Bitcoin's core principles—decentralized, proof-of-work consensus—their approaches to functionality diverge sharply, reflecting different visions for cryptocurrency.

- Scaling and Transaction Efficiency: BCH excels in on-chain scaling with dynamic block sizes (up to 32 MB and beyond), enabling low fees (often under $0.01) and fast confirmations for everyday payments. This makes it ideal for microtransactions, remittances, and merchant adoption. In contrast, BTC sticks to 1 MB blocks (effective ~4 MB with SegWit), leading to higher fees during congestion (sometimes $50+!). BTC relies on off-chain Layer 2 solutions like the Lightning Network for speed, but this adds complexity and potential centralization risks and is in direct contrast to the Bitcoin Whitepaper that starts its description of Bitcoin as "A purely peer-to-peer version of electronic cash".

- Smart Contracts and Tokens: BCH's recent upgrades, like CashTokens and BigInt, allow native token creation (fungible and NFTs), covenants for automated agreements, and high-precision math for DeFi. This positions BCH as a versatile platform for DApps without needing sidechains. BTC, post-Taproot (2021), supports basic smart contracts and innovations like Ordinals (NFT-like inscriptions), but its scripting is more limited, and high fees hinder widespread use.

- Usability and Adoption: BCH prioritizes being "cash"—simple, reliable, and accessible for global payments. Features like Double Spend Proofs enhance merchant confidence without waiting for multiple confirmations. BTC, often called "digital gold," focuses on security and long-term value storage, with upgrades like Schnorr (via Taproot) improving privacy but not addressing on-chain throughput.

In essence, BCH functions as an efficient payment system for the masses (as intended), while BTC serves as a secure asset reserve (not as intended). If you're looking for cheap, quick transfers or building tokenized ecosystems, BCH's on-chain focus gives it an edge.

Looking Ahead

Bitcoin Cash continues to evolve, staying true to Satoshi Nakamoto's vision of scalable electronic cash. With its latest 2025 upgrades boosting smart contract prowess, BCH is well-positioned for broader adoption in payments, DeFi, and beyond. Whether you're a holder, developer, or user, keep an eye on this dynamic chain—it's proving that big blocks can mean big possibilities.

Thanks for reading! If you have thoughts on BCH or suggestions for future topics, stay tuned for more Bitcoin deep dives.

Sources for this newsletter include detailed timelines from Bitcoin Cash community resources and recent upgrade announcements.